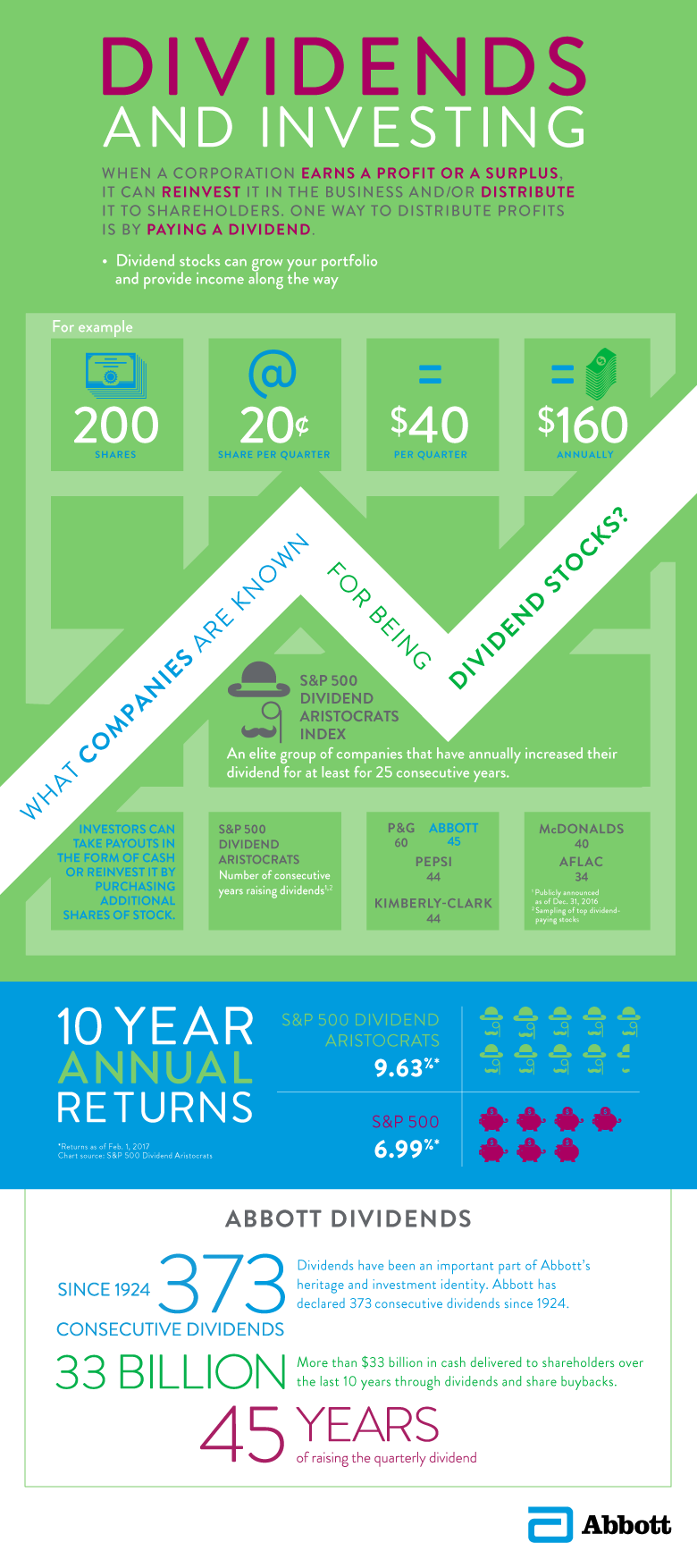

We added to this track-record today by declaring our 373rd consecutive quarterly dividend.

Dividend 101

When a corporation earns a profit or a surplus, it can reinvest it in the business and/or distribute it to shareholders. One way to distribute these profits is by paying a cash dividend to shareholders.

If you own shares, you will receive a payout each time the company pays a dividend. You can also choose to receive your dividend in the form of cash or reinvest it by purchasing additional shares of stock.

Companies that have annually increased their dividend payout for at least 25 consecutive years are included on the S&P 500 Dividend Aristocrats Index. Abbott is a member of this elite group of companies, marking 45 consecutive years of dividend increases.

According to a Morgan Stanley study, dividends accounted for nearly 42 percent of the total return of the S&P 500 stock market index from 1930 to 2012.

Abbott: Consistently Delivering Value

By investing in areas that are aligned with healthcare trends, Abbott is well-positioned for growth for many years to come. In 2016, we took deliberate steps to shape our business and advance our pipeline with the acquisition of St. Jude Medical. Combined, Abbott now has one of the best – and most competitive – medical device businesses in the world.

Today, all of Abbott’s four core businesses – devices, diagnostics, nutrition and medicines – hold leading positions in large and growing markets.

Innovation is also adding to Abbott’s strength. The company is experiencing a golden age of innovation. Not only are we addressing important unmet medical needs with our breakthrough inventions, we are also creating value for our shareholders for the long-term.

Please be aware that the website you have requested is intended for the residents of a particular country or region, as noted on that site. As a result, the site may contain information on pharmaceuticals, medical devices and other products or uses of those products that are not approved in other countries or regions.

The website you have requested also may not be optimized for your specific screen size.

FOLLOW ABBOTT